A financial advisor plays a vital position in helping people and corporations navigate the complexities of monetary scheduling. These professionals offer assistance on an array of economic matters, which includes investments, tax techniques, retirement organizing, and threat management. A monetary advisor’s Main responsibility would be to evaluate a customer's fiscal predicament, recognize their ambitions, and build a customized plan that will help them realize People targets. This may require recommending distinct investment decision goods, developing a funds, or advising on debt administration methods. By getting a holistic strategy, a economical advisor makes sure that all components of a consumer's financial daily life are aligned and dealing collectively to create prolonged-time period economic security and development.

In combination with giving individualized suggestions, a money advisor also provides ongoing assist and checking. As economical markets and personal conditions improve, the advisor continuously evaluations and adjusts the money plan to keep it on course. This dynamic technique can help clients stay focused on their financial objectives, even inside the experience of current market volatility or everyday living changes such as a job decline or a new addition to the family. A monetary advisor is often found to be a dependable lover who delivers goal suggestions and assists customers make educated selections. This romantic relationship can span decades, evolving as the customer’s fiscal requirements change eventually.

The purpose of a economical advisor is frequently puzzled with that of the economic planner, but you will find distinctive distinctions between the two. A financial planner concentrates on producing in depth fiscal plans that deal with multiple facets of somebody’s economic everyday living, including retirement scheduling, estate organizing, and coverage wants. When both fiscal advisors and economical planners assist consumers regulate their funds, a monetary planner generally concentrates on extensive-time period techniques rather then short-term investment decision choices. A fiscal planner’s get the job done normally involves making comprehensive roadmaps that outline actions to achieve certain fiscal ambitions, for instance conserving for a child’s education or planning for a snug retirement.

A economical planner takes advantage of numerous resources and methods to assist customers reach their ambitions. These may well incorporate retirement calculators, budgeting computer software, and tax scheduling resources. By examining a shopper’s current economical condition and projecting long run revenue and costs, a economical planner can produce a plan that balances rapid wants with long-expression aims. This normally includes establishing many cost savings and expense accounts, Every single customized to a specific aim. For example, a economic planner may well advise a 529 school personal savings prepare for education and learning expenditures, a 401(k) or IRA for retirement personal savings, in addition to a existence insurance plan to protect the spouse and children’s monetary foreseeable future. Via watchful setting up and disciplined execution, a economical planner helps clients Create prosperity and safe their economic future.

In contrast to a economic advisor or possibly a fiscal planner, a prosperity manager normally is effective with superior-net-really worth people who demand a lot more specialized companies. Wealth managers give a wide array of companies, which includes expense management, tax preparing, estate preparing, and from time to time even philanthropic preparing. The primary target of a prosperity manager will be to preserve and improve their consumers’ prosperity in excess of the long run. They typically work with purchasers who've elaborate economic cases, including various revenue streams, business enterprise ownership, or important housing holdings. A wealth manager’s skills goes further than fundamental fiscal scheduling; they provide advanced approaches to improve prosperity and lower tax liabilities.

Prosperity managers frequently operate carefully with other industry experts, which include tax advisors, estate Lawyers, and insurance coverage specialists, to supply a comprehensive suite of providers. This collaborative strategy makes sure that all facets Wealth Manager of a consumer’s wealth are managed cohesively. As an example, a wealth supervisor could possibly do the job having an estate legal professional to make a have faith in that minimizes estate taxes although making certain that assets are transferred in accordance with the customer’s wishes. At the same time, they could collaborate by using a tax advisor to build methods that reduce the customer’s Total tax burden, both of those now Wealth Manager and Sooner or later. Wealth administrators are notably competent at navigating the complexities of prosperity preservation, supporting clientele protect their property from dangers which include inflation, market place downturns, and legal troubles.

Although the roles of monetary advisor, economic planner, and prosperity manager may possibly overlap, Every delivers a unique set of competencies and knowledge into the table. A fiscal advisor is commonly the initial issue of Make contact with for people seeking fiscal steerage. They provide broad tips on a variety of topics, from budgeting to investment decision range. A financial planner will take a more in-depth tactic, specializing in extensive-term methods that align Together with the customer’s lifetime plans. In distinction, a prosperity supervisor caters to your requires of affluent shoppers, offering specialised services designed to maintain and grow significant belongings.

Picking out concerning a economical advisor, economical planner, or prosperity manager depends mainly on someone’s economic circumstance and objectives. For somebody just starting off their money journey, a fiscal advisor could be the most effective match, offering steering on standard monetary issues and aiding to establish a stable foundation. As that unique’s fiscal scenario results in being far more complicated, they may flip to your monetary planner to establish a comprehensive system that addresses numerous areas of their finances. Last but not least, as prosperity accumulates and monetary desires turn out to be all the more sophisticated, a wealth manager can offer the specialised solutions needed to regulate and safeguard major belongings.

Whatever the particular title, the principal target of such experts is to help you purchasers reach monetary safety and comfort. Irrespective of whether it’s a financial advisor assisting a young couple spending budget for their initial house, a economic planner building a retirement approach for the middle-aged Expert, or even a wealth supervisor advising a company proprietor on estate preparing, these professionals Perform a crucial role in guiding clients as a result of lifetime’s money issues. By offering professional advice and personalised techniques, they assist purchasers make knowledgeable conclusions that bring on extended-time period fiscal good results.

In today’s advanced economic landscape, the necessity for Skilled guidance has not been bigger. A fiscal advisor, financial planner, or wealth supervisor might help persons and families navigate the myriad of possibilities and decisions they experience. From selecting the best investments to scheduling for retirement, these specialists present beneficial insights and approaches which can make a substantial variation in acquiring monetary ambitions. As purchasers’ needs evolve, these monetary authorities deliver the continued assistance and adjustments essential to hold them on target, making sure that their economical designs remain relevant and efficient with time.

Eventually, no matter Financial Planner whether one particular performs by using a fiscal advisor, economic planner, or wealth supervisor, The real key to achievements lies in creating a robust, trusting connection. These experts are not merely advisors; These are companions within the journey towards fiscal effectively-being. By being familiar with their purchasers’ special needs and aims, they can provide personalized suggestions and solutions that empower purchasers to get Charge of their economic upcoming. By way of careful setting up, disciplined execution, and ongoing assistance, a money advisor, monetary planner, or wealth supervisor might help purchasers achieve the fiscal stability and reassurance they search for.

Mackenzie Rosman Then & Now!

Mackenzie Rosman Then & Now! Elisabeth Shue Then & Now!

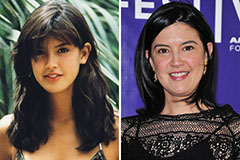

Elisabeth Shue Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!